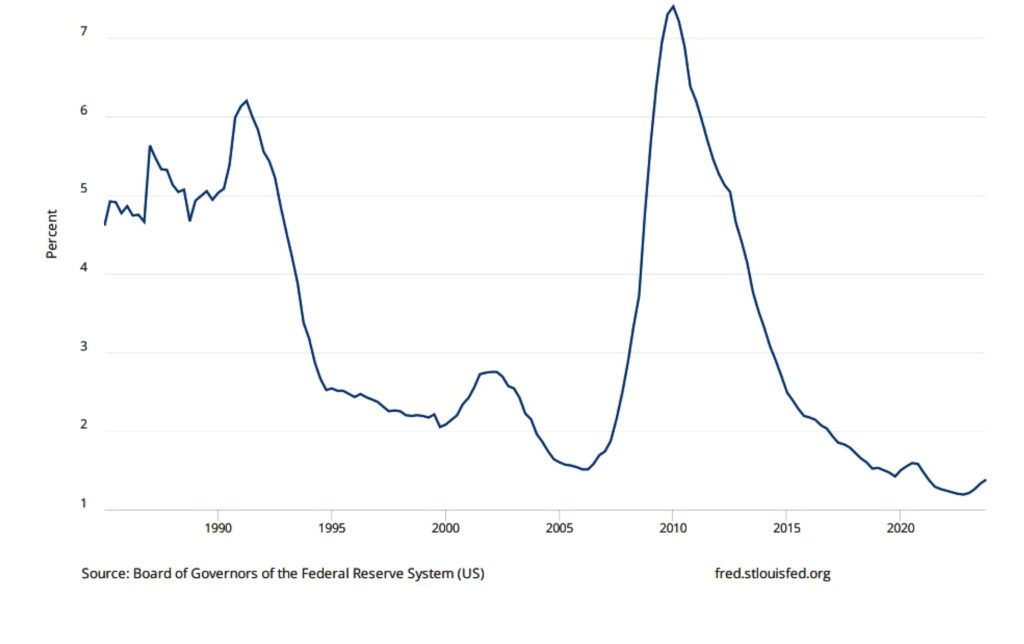

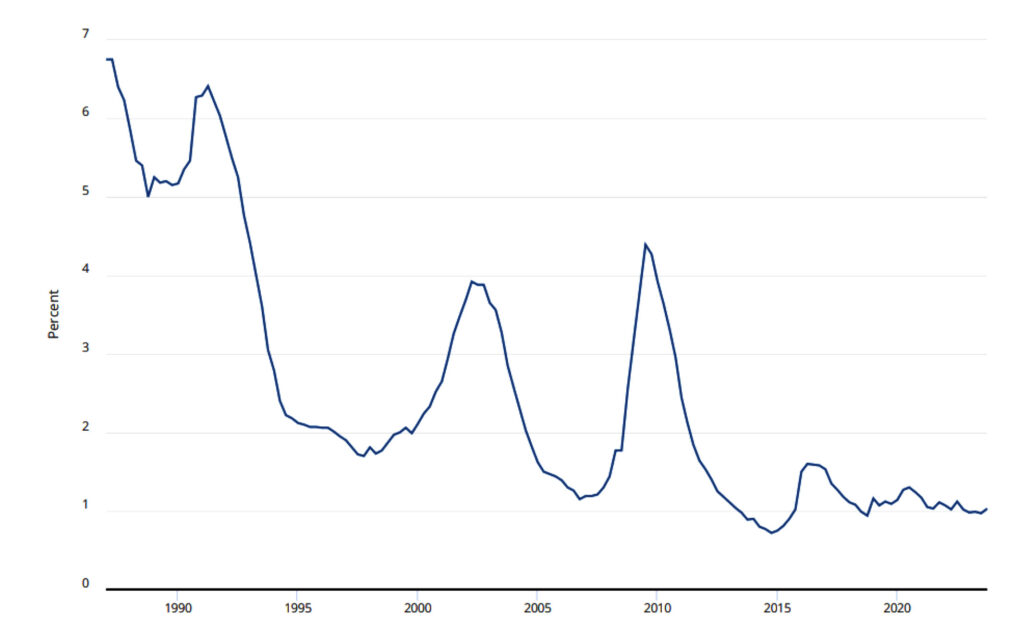

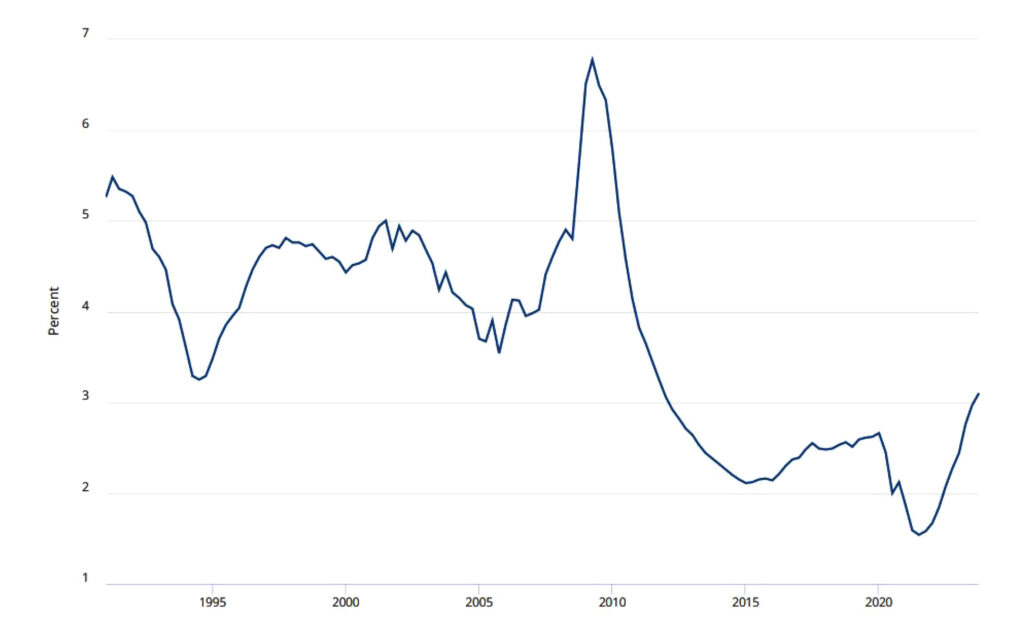

There seems to be a misperception that the defaults during the pandemic flushed out many of the high-risk companies. The seasonally adjusted default rate on loans by commercial banks is shown below. The pandemic peak of 1.59% in Q3 2020 was only marginally higher than the pre-pandemic low of 1.42% in Q4 2019.1 The third graph showing the decline in delinquencies over the last 10 years provides more detail about the bump up in delinquencies as the effects of the cash transfers from the stimulus packages have worn off. The recent increase in delinquencies may be prologue to future problems. The fact that the large decline in delinquencies from 1991 to 2006 preceded the financial crisis may be a coincidence—or not. It could be an indicator of how rot in the system can accumulate. Many commentators on the macro-economy are inferring low future default rates from the current low level of defaults. This could lead to complacency among their readers. Complacency and overconfidence are often precursors of future crises. When the consensus is for a soft landing—or no landing—I get worried.

Delinquency Rate on All Loans, All Commercial Banks2

Delinquency Rate on Business Loans, All Commercial Banks3

Delinquency Rate on Credit Card Loans, All Commercial Banks4

The very low delinquency rates during the past 10 years are, I believe, due to a combination of low interest rates, easy credit by banks, including issuance of covenant-lite bonds, and massive transfers to firms that claimed they were in bad shape and would otherwise need to lay off workers, as well as cash transfers to individuals during the pandemic that generated high levels of consumer spending. These easy credit conditions and government support for businesses, business owners and their customers have enabled firms to stay in business that are not economically viable. Reuters quotes CreditSights as stating that “More than $190 billion of the debt maturing in 2024-2025 belongs to the lowest-rated high-yield companies.”5 Although interest payments by households as a fraction of personal income are not exceptionally high by historical standards, that number is distorted by the low interest rates on most mortgages. Rents are a fixed cost that have increased strongly in recent years. Delinquency rates on credit card debt and auto loans have risen, and transitions into delinquency are at more than ten year highs.6 The delinquency rates on credit cards and auto loans may be leading to defaults as the benefits of low historic home mortgage rates dissipate. Defaults on auto loans and credit cards directly affect businesses in ways that defaults on loans from government sponsored enterprises, such as Fannie Mae, or student loans from government entities do not.

Delinquency Rate on Credit Card Loans, All Commercial Banks (2013-2023)7

The U.S. long-term debt seems unsustainable unless U.S. debt is held for reasons that are divorced from U.S. GDP, tax revenues of the U.S. or the interest on the debt. There are many assets with no yield or even negative yields that are held as a store of value: gold, rare stamps, rare coins, Bitcoin. As long as the holders think that future demand will sustain or increase the price, then the “right” price for U.S. debt becomes a matter of psychology not economics. There is also a demand for U.S. debt by foreign central banks who want to control their currency and improve their terms of trade. This demand is driven by geopolitical factors, and only to a limited extent by economics. On the other hand, there are holders of U.S. debt that are sensitive to yield and to the risk of default. If the U.S. were to default on its debt then presumably the markets would adjust and the price would fall.

The stringent capital requirements being imposed on the banks due to Basel III and recent moves by the Federal Reserve to impose more stringent capital requirements will cause the shadow banks to be an increasingly important source of loans—largely through their purchases of securitized loans but also through direct lending. If the shadow banks suffer withdrawals, the supply of credit to borrowers could be significantly curtailed.

Another macro-economic risk would follow from Trump being elected and imposing a 10% tariff on all imports—a policy he has advocated for.8 In that case I would expect retaliatory tariffs on U.S. exports. Trump has said he will increase tariffs beyond the 10% level on countries that retaliate by raising tariffs on their imports from the U.S.9 This could lead to “tit for tat” escalation in tariffs resulting in a major disruption in the U.S. economy and the economies of our major trading partners.

The low expected volatility of equities as expressed in option markets seems at odds with the high expected volatility of interest rates as expressed in interest rate swaptions. Normally one would expect high volatility in interest rates to be an indicator that investors think there will be high volatility in the economy, which should cause more volatility in equities. The high level of geopolitical risks in Korea would seem to be more consistent with higher volatility of equities.10 In conclusion, the one prediction about which I’m most confident is that the next crisis will be different from previous ones. At the current state of artificial intelligence I believe that data and computer models should be regarded as tools that complement judgment, not as substitutes for careful consideration of current conditions.

Sincerely,

Andrew Weiss | CEO, Weiss Asset Management

Disclaimers:

This commentary has been prepared by Dr. Andrew Weiss and reflects the opinions of Dr. Weiss. This is not an offer to sell, nor a solicitation of an offer to buy any security of any fund (a “Fund”) managed by Weiss Asset Management LP or its affiliates (“WAM”) or any other investment product or strategy. Offers to sell or solicitations to invest in a Fund are made only by means of a confidential offering memorandum and in accordance with applicable securities laws. An investment in a Fund involves a high degree of risk and is suitable only for sophisticated investors that are qualified to invest therein. Commodity trading involves a substantial risk of loss.

This commentary may not be reproduced or further distributed without the written permission of Dr. Weiss. This material has been prepared from original sources and data believed to be reliable. However, no representations are made as to the accuracy or completeness thereof.

Although not generally stated throughout, this commentary reflects the opinion of Dr. Weiss, which opinion is subject to change and neither Dr. Weiss nor WAM shall have any obligation to inform you of any such changes.

This commentary includes forward-looking statements, including projections of future economic conditions. Neither Dr. Weiss nor WAM makes any representation, warranty, guaranty or other assurance whatsoever that any of such forward-looking statements will prove to be accurate. There is a substantial likelihood that at least some, if not all, of the forward-looking statements included in this commentary will prove to be inaccurate, possibly to a significant degree.